What a CP2000 notice for crypto means and how to respond

Key takeaways

- Respond promptly: Address your CP2000 notice within the specified timeframe to prevent escalation.

- Understand the notice: Grasp what the CP2000 notice entails for your cryptocurrency activities.

- Leverage professional tools: Use Crypto Tax Calculator to audit your activities and ensure accurate reporting.

If you’ve received a CP2000 notice for crypto, you need to take immediate action. This guide explains what a CP2000 notice means for crypto investors, how to respond, and steps to avoid future issues.

What is a CP2000 notice?

A CP2000 notice is a letter from the IRS indicating discrepancies between the income you reported and the information they received from third parties. It suggests that you may owe additional taxes, including from cryptocurrency transactions. According to the IRS, a CP2000 notice is not a bill but a proposal for additional taxes based on the data mismatch.

Why have I received a CP2000 notice?

You may receive a CP2000 notice for crypto if:

- Unreported income: Income from crypto trading, mining, or staking wasn’t reported on your tax return.

- Mismatch in records: The IRS received information from exchanges that do not match your filings.

- High-value transactions: Large or frequent crypto transactions can trigger IRS scrutiny.

- Errors in reporting: Mistakes in reporting gains or losses can lead to notices.

Example: Jane received a CP2000 notice after the IRS found discrepancies in her reported income from trading Bitcoin. Her exchange reported higher earnings than what she included on her tax return. Receiving a CP2000 notice often results from the IRS identifying inconsistencies in your reported income compared to third-party data.

What a CP2000 notice means for crypto investors

Receiving a CP2000 notice means the IRS believes there are unreported, underreported, or inaccurate crypto transactions on your tax return. This may be due to discrepancies between what you reported on your tax return and information the IRS has about your activities, which may have been provided by crypto exchanges, wallet providers, etc.

Receiving a CP2000 can lead to:

- Additional taxes owed based on the IRS’s findings.

- Penalties and interest for underreporting income.

- Potential audits and increased likelihood of a full tax audit.

- Enhanced scrutiny and compliance monitoring of your financial activities in the future.

The IRS emphasizes that a CP2000 notice is a chance to correct errors before more severe actions are taken.

How do I respond to a CP2000 notice?

How to Dispute a CP2000 notice:

- Review the notice carefully: Identify the discrepancies highlighted.

- Gather documentation: Collect all relevant crypto transaction records.

- Respond within the deadline: Typically 30 days, but follow the notice’s instructions.

- Provide explanations: Clearly state reasons for any disagreements and include supporting evidence.

- Consult a tax professional: Ensure your response is accurate and comprehensive.

The IRS advises taxpayers to respond promptly and provide all requested information to resolve discrepancies.

If you lodged your tax return through a third-party, then you should also contact them directly if you discover any errors in your forms that have been sent to the IRS.

Review the proposed amount due

The notice will detail the IRS’s proposed additional tax, penalties, and interest. Assess this amount against your records to determine accuracy.

Example: John received a CP2000 notice proposing an additional $1,000 in taxes due to unreported crypto gains. Upon reviewing his records, he found that he had correctly reported all transactions, disputing the IRS's calculations.

Action Steps:

- If you agree: Arrange payment promptly to avoid further penalties.

- If you disagree: Follow the dispute process to present your case, providing all necessary documentation and explanations.

Is the IRS aware of my crypto transactions?

The IRS is increasingly aware of cryptocurrency transactions through:

- Exchange reporting: Crypto exchanges report transactions via Forms 1099-K and 1099-B.

- Advanced blockchain analytics tools: These tools track and analyze blockchain transactions.

- International data sharing: Cooperation with foreign tax authorities for comprehensive data.

- Self-reporting requirements: Taxpayers must report all crypto income and gains accurately.

What happens if you don’t report crypto to the IRS?

- Penalties and fines: Up to 75% of the unpaid tax due to fraud.

- Interest charges: On overdue amounts.

- Criminal charges: In severe cases of tax evasion.

- Increased audits: Higher likelihood of a full tax audit.

Learn more about how the IRS knows you’ve traded crypto and what you need to report with our comprehensive US crypto tax guide.

How to get help with your CP2000 notice for crypto

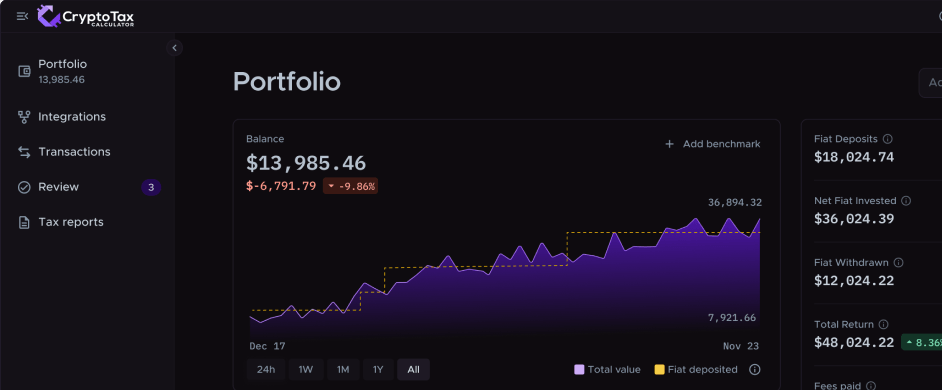

Navigating a CP2000 notice can be complex. Crypto Tax Calculator can assist by:

- Automating calculations: Ensure accuracy in reporting.

- Organizing records: Simplify documentation management.

- Guiding responses: Provide templates and advice for your reply.

Visit our homepage to explore how Crypto Tax Calculator can help you manage your cryptocurrency tax reporting and stay compliant with IRS regulations. Check out our US crypto tax guide to learn more about your reporting requirements and how to navigate them.

Sources

Understanding Your CP2000 Series Notice, Internal Revenue Service (IRS), 2024 IRS CP2000 Series Notice IRS Virtual Currency Guidance, Internal Revenue Service, 2014 IRS Notice 2014-21 Tax Reform Basics for Individuals and Families, Internal Revenue Service, 2021 IRS Publication 5307 Topic No. 409 Capital Gains and Losses, Internal Revenue Service, 2022 IRS Topic No. 409 Charitable Contributions, Internal Revenue Service, 2022 IRS Publication 526 Retirement Plans FAQs Regarding IRAs Investments in Cryptocurrencies, Internal Revenue Service, 2021, IRS IRA FAQs Frequently Asked Questions on Virtual Currency Transactions, Internal Revenue Service, 2023, IRS Virtual Currency FAQs

See the full picture

Get on top of your taxes with accurate reports ready for the IRS and TurboTax

No credit card required

Crypto Tax Guide

Unsure about your crypto tax obligations? This comprehensive guide helps you understand and file your crypto taxes.

Learn about crypto taxes

DeFi Tax Guide

Have you been dabbling with DeFi? This in-depth guide breaks down the details of DeFi taxes so you can file with confidence.

Learn about DeFi taxes

NFT Tax Guide

Tried your hand at NFT trading? This complete guide that breaks down the details of NFT taxes so you can file with confidence.

Learn about NFT taxes